This assessment ensures investments contribute positively to the company’s financial health. With a contribution margin of $200,000, the company is making enough money to cover its fixed costs of $160,000, with $40,000 left over in profit. To convert the contribution margin into the contribution margin ratio, we’ll divide the contribution margin by the sales revenue. The contribution peanut butter price history from 1997 through 2021 margin ratio takes the analysis a step further to show the percentage of each unit sale that contributes to covering the company’s variable costs and profit. Thus, the level of production along with the contribution margin are essential factors in developing your business. Now, it is essential to divide the cost of manufacturing your products between fixed and variable costs.

- To understand how profitable a business is, many leaders look at profit margin, which measures the total amount by which revenue from sales exceeds costs.

- Alternatively, the company can also try finding ways to improve revenues.

- And the quickest way to make the needed changes is to use a scheduling and labor management tool like Sling.

- Sales (a.k.a. total sales or revenue) is the monetary value of the goods or services sold by your business during a certain reporting period (e.g., quarterly or annually).

- All of our content is based on objective analysis, and the opinions are our own.

Formula

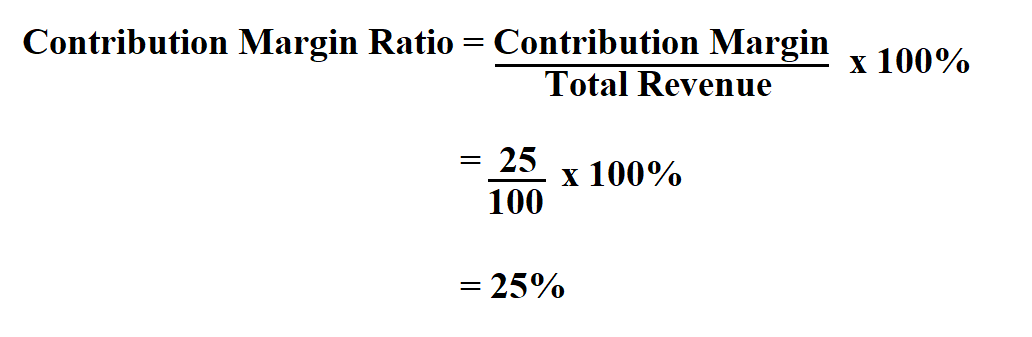

If you need to estimate how much of your business’s revenues will be available to cover the fixed expenses after dealing with the variable costs, this calculator is the perfect tool for you. You can use it to learn how to calculate contribution margin, provided you know the selling price per unit, the variable cost per unit, and the number of units you produce. The calculator will not only calculate the margin itself but will also return the contribution margin ratio. The contribution margin is a profitability metric that measures how selling a particular product affects a company’s operating income. It is calculated as the selling price per unit, minus the variable cost per unit.

Variable Costs

Find out what a contribution margin is, why it is important, and how to calculate it. The following are the disadvantages of the contribution margin analysis. Learn about the time interest earned ratio and how to calculate it.

Why You Can Trust Finance Strategists

The more it produces in a given month, the more raw materials it requires. Likewise, a cafe owner needs things like coffee and pastries to sell to visitors. The more customers she serves, the more food and beverages she must buy.

Sales

So, it is an important financial ratio to examine the effectiveness of your business operations. Say, your business manufactures 100 units of umbrellas incurring a total variable cost of $500. Accordingly, the Contribution Margin Per Unit of Umbrella would be as follows. Furthermore, it also gives you an understanding of the amount of profit you can generate after covering your fixed cost.

Contribution Margin vs. Gross Margin: What is the Difference?

Based on the contribution margin formula, there are two ways for a company to increase its contribution margins; They can find ways to increase revenues, or they can reduce their variable costs. Fixed costs are costs that are incurred independent of how much is sold or produced. Buying items such as machinery is a typical example of a fixed cost, specifically a one-time fixed cost.

This is because the contribution margin ratio lets you know the proportion of profit that your business generates at a given level of output. Sales revenue refers to the total income your business generates as a result of selling goods or services. Furthermore, sales revenue can be categorized into gross and net sales revenue. Fixed costs are the costs that do not change with the change in the level of output. In other words, fixed costs are not dependent on your business’s productivity. So, you should produce those goods that generate a high contribution margin.

In fact, we can create a specialized income statement called a contribution margin income statement to determine how changes in sales volume impact the bottom line. The contribution margin ratio (CM ratio) is an important financial metric that shows how a company’s sales affect its profitability. It reflects the portion of each dollar of revenue that is available to cover fixed costs and contribute to net profit after variable costs have been paid. The contribution margin is a cost accounting concept that lets a company know how much each unit sold contributes to covering fixed costs after all variable costs have been paid. It can be calculated on a per-unit basis, or as a ratio, often expressed as a percentage. The break even point (BEP) is the number of units at which total revenue (selling price per unit) equals total cost (fixed costs + variable cost).